Factoring

Introduction Factoring can improve cash flow and operational efficiencies, and it is used in many industries, including the healthcare sector. With this strategy, businesses sell their accounts receivable at a discount to a factoring company (the factor), giving them access to quick cash. The burden of recovering the debt from the consumer who has not paid their invoice is transferred to the factoring company. The corporation has access to its earnings immediately, skipping the customary payout period (Ferguson, 2020, Factris, 2021). Popularity of Factoring The worldwide factoring services industry will reach USD 3.5 billion by 2032, growing 8.5% annually. The market’s growth is driven by cash flow management, working capital financing, and SMEs’ use of factoring services (FID Reports and Data, 2023). The U.S. factoring services market will reach USD 287.61 billion by 2030, growing 8.1% from 153.96 billion in 2022 (Grand View Research, 2023). According to a survey, factoring services have grown in popularity, especially among Micro, Small, and Medium-Sized Enterprises (MSMEs) that have trouble securing appropriate financing, particularly in working capital. There are 127 factoring companies in the US and Canada. Mazon Associates in Dallas, Crown Financial in Houston, Provident Commercial Finance in Chattanooga, Bankers Factoring near Atlanta, J D Factors in Los Angeles, and Velocity Financial in Midland are considered to be the top-performing 2023 companies (Factoring Club, 2023). A few other examples include (Treece, 2023): FundThrough offers 100% advance rates on up to $10 million in finance, with costs starting at 2.75%. Riviera Finance offers 95% advances on $5,000–$2 million loans. They are known for their individualized service and face-to-face knowledge. altLINE offers up to 90% advances and can quote lending amounts. They specialize in huge invoices and charge 0.50% APR. TCI Business Capital finance $50,000–$10 million at 60%–90% advance rates. They offer bespoke factoring solutions and don’t disclose their APR. Healthcare providers frequently encounter delays in receiving reimbursements from insurance companies. The quality of healthcare providers’ services may suffer due to delays (Fundbox, 2023). Healthcare providers use factoring firms to speed up the payment procedure. They sell the health insurance claims—basically unpaid invoices—to factoring companies, who recover the claim payments from the insurance providers. By ensuring prompt claim payouts, this method aids healthcare providers in maintaining their highest levels of operational effectiveness. On the other hand, some practice owners may disapprove of the factor’s specific approach to managing patient or payer interactions (Factris, 2021). Factoring Process Initially, healthcare vendors or medical providers send invoices (claims) to either a medical provider or third-party payer (Medicaid, Medicare, private insurance companies) for services rendered or goods provided. Following this, a copy of the invoices, along with any supporting documentation, is submitted to a factoring company like PRN Funding, LLC (PRN Funding, 2020). Subsequently, the factoring company purchases these invoices and advances 80-90% of their face value, with funds typically deposited directly into the vendor’s or provider’s bank account within 24-72 hours. The remaining percentage is used as a buffer in case some bills do not get paid or if there are billing errors. Eventually, the reserve, less the factoring fee, is released back to the vendor or provider after receiving payments (PRN Funding, 2020). Step-by-Step: Healthcare vendors or medical providers send medical claims to medical providers or third-party payers (such as Medicaid, Medicare, or private insurance companies). A factoring business (the factor) Receives copies of the invoices and any necessary supporting documentation. Purchases these invoices at a discount, typically around 80-90% of their face value. Advances the funds directly into the vendor’s or provider’s bank account within 24-72 hours. Holds a portion of the invoice amount as a reserve in case some bills go unpaid or there are billing errors. Assumes the responsibility of collecting outstanding payments from insurance providers, relieving the healthcare provider from the burden of debt collection. Collects the payments received from insurance companies or third-party payers. Releases the reserve, minus the factoring fee, back to the vendor or provider once the payments are received. How does the factor estimate the quality of the outstanding claims? The factor assesses the quality of outstanding claims through various methods and criteria. This assessment helps determine the likelihood of prompt payment, helps minimize non-payment risk, and ensures that the factor can provide immediate capital to healthcare providers while maintaining a reasonable level of risk. Here’s how the factor determines the quality of the outstanding claims: Evaluation of the payer: The factor examines the insurance companies or third-party payers responsible for reimbursing the claims. They consider the payer’s reputation, track record of timely payments, financial stability, credit scores, and payment history. Specific policies, guidelines, and requirements for claim processing. These include claim submission deadlines, pre-authorization requirements, and claim acceptance rates. Collaboration with healthcare providers: Factors collaborate closely with healthcare providers to gather information about outstanding claims. Providers may share their experiences with different payers, providing valuable insights into the quality and reliability of the claims. Verification of claim documentation: The factor reviews the supporting documentation accompanying the outstanding claims. This includes verifying the accuracy and completeness of the medical records, coding, and billing information. Thorough documentation ensures that the claims are valid and are more likely to be paid. Analysis of historical data: The factor analyzes the provider’s historical payment patterns from different insurance companies or payers. This analysis helps identify any trends or patterns of delayed payments or denials, providing insights into the quality and reliability of the outstanding claims. Industry Knowledge and Expertise: Factors with experience in the healthcare industry develop expertise and knowledge about various payers, their reimbursement practices, and the industry’s dynamics. They stay updated with industry news, regulatory changes, and trends that may affect payment processes. This industry knowledge enables them to predict payment delays and amounts. Strategies for Choosing the Best Factor for Your Practice The factor selection decision depends on the factor’s stability and track record, the factoring service fees (2%-3.5% monthly was typical in 2022), the terms of the factoring agreement, the type

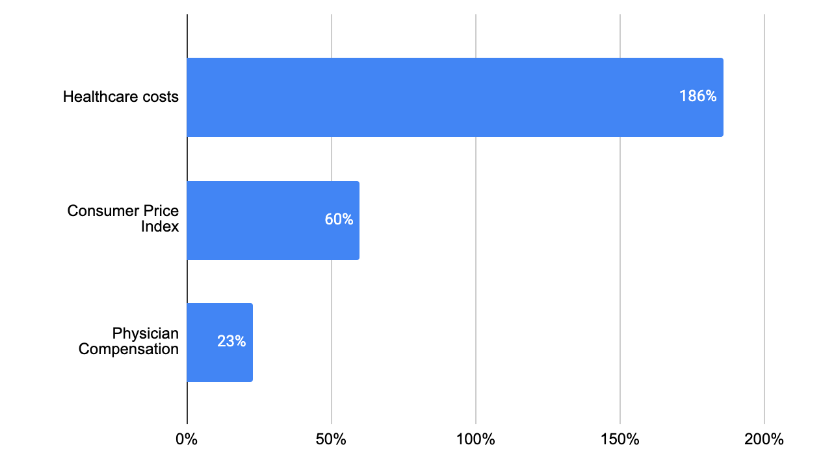

Has the Provider’s Compensation Kept Up With the Economy or Healthcare Costs?

The U.S. faces escalating healthcare spending, with 2021 per capita costs reaching $12,318. Compared to advanced economies, the U.S. spent double the amount on healthcare. Factors contributing to this include an aging population, expensive medical innovations, and defensive medicine practices. Chronic diseases among older adults are a significant cost driver. Rising healthcare expenditures and declining physician income create a paradox in the industry. The excessive cost of medical innovation, demographic shifts, and defensive medical practices challenge healthcare affordability and sustainability.

Navigating Insurance Audits and Compliance

Health insurance audits can be daunting for private practices. Auditors aim to ensure correct billing and proper claims handling. Audits can be routine or event-triggered, conducted by payors, either commercial insurance providers or government entities. Preparation and education are key to surviving audits. Providers should maintain compliant documentation, understand the audit process, and use practice management platforms like ClinicMind to streamline recordkeeping and compliance, making audits less intimidating.

Using Analytics to Optimize Insurance Management

Analytics play a crucial role in optimizing insurance management for private practices and healthcare providers. Monitoring approvals, denials, and appeals provides valuable insights. Identifying the specific reasons behind denials, like coding errors or insufficient documentation, helps address underlying issues. Analytics offer quantifiable insights to streamline operations, reduce inconsistencies, and adapt to evolving circumstances. ClinicMind’s EHR/RCM platform offers comprehensive reporting and analytics features to enhance insurance management, improving practice efficiency.