How to Reduce Your Tax Burden & Boost Your Productivity

by Garrett B. Gunderson with Brett Sellers, CPAAs a Financial Advocate to chiropractors, dentists and other professionals, I once performed a survey of my doctor clients. Out of 117 doctors, 107 of them were overpaying on their taxes—and many of them by tens of thousands per year.

This can be easily avoided, and reducing your taxes is the lowest-hanging fruit for increasing your cash flow and productivity.

Here are the most important things every business owner should know about taxes:

Don’t Let the Tax Tail Wag the Dog of Productivity

Would you rather pay $1 million or $10 million in income tax? Most people say $1 million. My answer is always $10 million, because it would mean I made much more money than if I owed $1 million.

Taxes should definitely be taken into consideration with any financial plan, but some businesses actually don’t want to produce more because they’re afraid of paying too much in taxes. They base financial decisions primarily on tax ramifications. In other words, they let the tax tail wag the dog of productivity.

Bottom line: Your first and best defense against taxes is always to earn another dollar, rather than limiting productivity and settling for a lower income in the name of saving on taxes.

Be Proactive, Not Reactive By Using a Tax Preparer, Rather than a Tax Strategist

Most small businesses have a CPA that simply prepares their taxes at the end of each year. This makes them reactive rather than proactive.

Instead of anticipating and strategically solving potential tax problems, such tax preparers scramble to limit your tax liability just once throughout the year. And to accomplish this, they usually tell you to dump as much money as possible into a qualified plan, or recommend other things that you otherwise wouldn’t do except to save on taxes, which creates even more problems down the road.

In contrast, a tax strategist makes tax season a non-issue by keeping you organized, creating and tracking financial benchmarks throughout the year, and limiting your tax burden.

Plan for the Future, Don’t Defer to the Future

Typical scenario: At year’s end you bring your taxes to your CPA, and one of her primary and automatic recommendations is to put money in a qualified retirement plan.

This is lazy accounting at best. Are taxes going up or down in the future? Do you plan on being more or less successful in the future? So why would it be a good strategy to save on taxes today in a way that creates a bigger tax burden tomorrow?

Of course, traditional retirement planners will tell you that when you retire you can live on 70 percent or less of your pre-retirement income, and that living on this percentage will lower your tax bracket.

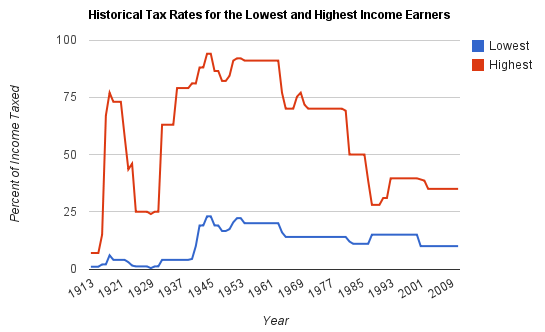

First of all, no one knows exactly what future tax brackets will be. And with the current economic and deficit environment do you think that tax rates are going to stay at these historic lows?

Historical marginal tax rates for the lowest and highest income earners in the United States. Source: U.S. Bureau of the Public Debt

Second, is this really how you want to spend your retirement years: living cheaply, afraid to spend the money you’ve earned for fear of triggering tax consequences? Do you really want to have a lower standard of living when you retire?

In contrast to qualified plans, there are other products and strategies that provide much better exit strategies upon retirement while still offering tax benefits during the growth phase.

This doesn’t necessarily mean you shouldn’t ever contribute to a qualified retirement plan. But such a decision needs to be part of a holistic, long-term financial plan that supports your purpose and passion, not a reactive and misguided accounting strategy based solely on numbers today.

Increase Your Deductions With Confidence

Entrepreneurs frequently ask CPAs for a clearly-defined, bullet-point list that spells out legitimate deductions explicitly.

But Section 162 of the IRS tax code simply states that you can deduct all “ordinary and necessary” business expenses. For most business owners, this means they can and should be deducting far more expenses than they currently are.

Deduct anything and everything connected with your business, while making sure you can build the case to support the connection.

Incorporate to Reduce Your Rate

I’m shocked by how many people operate as sole proprietors, which is the worst arrangement possible for taxes.

Incorporating limits your liability and protects your personal assets, increases your deductible expenses, gives you greater tax flexibility, and helps you build a sellable business.

A competent attorney that coordinates the strategy with your CPA can help you choose and properly structure the right entity.

Withdraw Business Income Strategically

As an owner of a business, you wear at least two hats (you may also be the landlord). You understand that you should be compensated as wages for the practice of dentistry for example, but how you withdraw business profits can have a significant impact on your taxes. Withdrawals can come in the form of additional salary or dividends.

Depending on your corporate structure, the withdrawal of dividends can greatly reduce your overall tax because certain distributions of corporate profits are not subject to employment or self-employment taxes.

Again, consult with a competent and strategic CPA to get further details for your unique situation.

Use Cost Segregation to Benefit from Depreciation

If you own your building, “cost segregation” can make a drastic difference in deductions due to depreciation.

This effective but under-utilized accounting technique shortens the depreciation period of your assets for taxation purposes, and results in reduced tax liability and increased cash flow.

The most effective way of segregating costs and supporting these accelerated depreciation deductions is to engage an engineering firm to perform a cost segregation study.

Get Deductions by Investing in Your Business

Section 179 of the IRS tax code allows you to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. The full purchase (or lease) price of qualifying equipment can be deducted from your gross income. It’s the government’s way of incentivizing businesses to invest in themselves.

Conclusion

You work hard for your money, and you deserve to keep as much of it as possible. Yes, you want to pay your fair share. But paying more than that is just bad accounting.

Put your taxes in their proper context and never let the tax tail wag the dog of productivity. And make sure you have the right tax strategist to safely and legally reduce your tax burden to bare minimum.

This is an expansive topic where Garrett and Brett will be diving deeper and giving more strategies and answers in a hold nothing back, comprehensive interview through the Curriculum for Wealth series. The objective is to save a hundred dollars a minute in tax for those that tune it. Check it out at www.freedomfasttrack.com/cfw

Garrett Gunderson is a Financial Advocate to professionals and the author of the New York Times, Wall Street Journal, USA Today, and Amazon bestseller Killing Sacred Cows: Overcoming the Financial Myths that are Destroying Your Prosperity.

Brett Sellers, CPA is a Tax Strategist to dentists and a partner in the firm of Stewart, Archibald and Barney, LLP.